Did you miss our Asset-Based Lending webinar?

Crowd Machine’s ABL solution changes the way lenders do business by giving you and your customers remote real-time access, with increased accuracy, efficiency, transparency, and confidence.

All-In-One ABL Platform

Created using Crowd Machine’s sophisticated no-code platform, our ABL solution is flexible, uniquely customizable, and scalable – differentiating itself from other static legacy solutions.

Designed in consultation with ABL industry experts, specific features and functionality applauded by customers include:

- Out-of-the-Box, All-in-One Solution

- 24-hour Service Level Agreements

- Online, Cloud-Based Document Storage

- Remote Access, Anywhere, Anytime

- Lender and Borrower Dynamic Real-Time Response and Information Access

- Customizable Features & Reports

Tailored To Your Requirements

Already adopted by major financial service businesses, Crowd Machine’s ABL solution provides commercial lenders, banks, and customers with a fully customizable solution. Our dynamic, real-time collateral monitoring and compliance solution effortlessly integrates with in-house core banking systems.

We provide customized cloud native solutions enabling your business to overcome challenges and achieve results, faster and more accurately than any other alternative.

“Crowd Machine’s ABL solution has notably improved past ABL systems, particularly with its ease of reporting and meeting compliance requirements, as well as the ability to scale and customize.”

Quick & Easy Migration

For a limited time only, you can remove the cost and risk of replacing your existing solution with Crowd Machine ABL. Talk to us today and don’t miss out on;

- FREE setup and migration from existing solution contract.*

- Data conversion of existing borrowers and customers.*

- Parallel running of systems to ensure smooth transition and ZERO interruption.

*T&C Apply.

Real-Time Loan Alerts

Providing loan alerts so users are immediately informed of any issues that may affect loan compliance or availability.

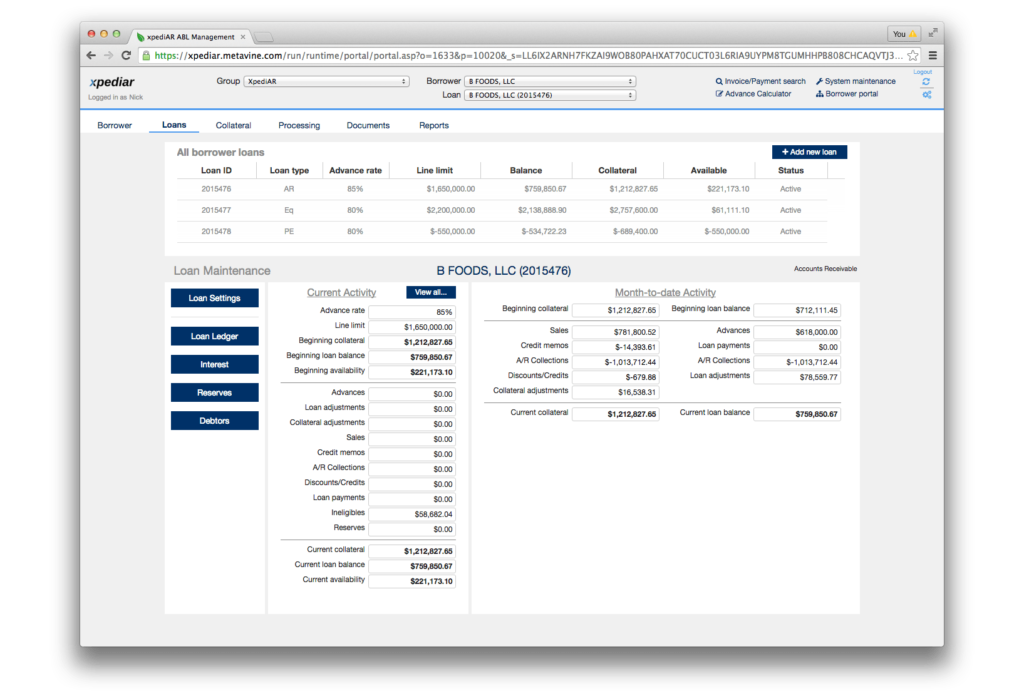

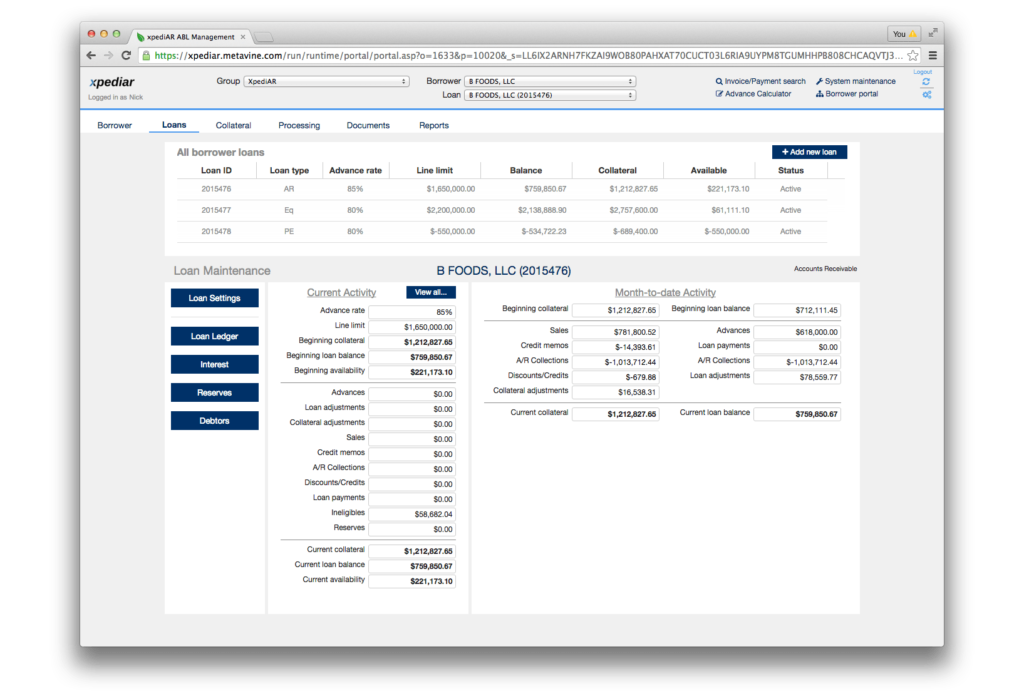

Borrower & Lender Portals

Lenders can manage loans, while borrowers gain access to loan information, collateral detail uploads, and drawdown requests.

Agile Reports & Dashboards

With over 55 standard reports straight out of the box, along with the ability to further create and customize your own reports & dashboards to suit what you and your customer need.

Monitoring & Analysis

Examine, monitor, track, and calculate borrowing base vs asset base via automated complex algorithms.

Unrivalled Transactions

Perform hundreds of thousands of daily transactions during peak load times – all in conformity with best industry practices.

- Home

- Asset Based Lending Solutions

Asset Based Lending Solutions

Dynamic Real-Time Borrowing

Crowd Machine ABL is a comprehensive field exam and loan management portfolio system. Using a number of complex algorithms to calculate the borrowing bases against an asset base, on a daily basis. The system automatically captures previous activity and calculates the availability based on recent live data. The collections, sales, agings, and ineligibles are auto processed so that loan officers can have accurate up-to-date information expediting advance approvals.

Compliance & Security

Crowd Machine ABL automatically recognizes variances, rather than relying on human detection. Strengthening fraud detection, providing reports on fraud items often found in aging, such as credit memos not reported, collection variances with the lender, and change of invoice amounts. These systems enable a loan officer to quickly see any deterioration in the borrower’s activity and respond.

On-Demand Performance

Mission critical ABL tasks have been improved, allowing more than one institution to share the credit with confidence. Easing the time and cost of borrower reporting and collateral monitoring, keeps up with changing market conditions, strengthens competitive edge, and increases customer satisfaction.

Cloud-Based Solution

Crowd Machine gives lenders real-time access and management of loan portfolios, increasing accuracy, efficiency, transparency, and confidence. Combining the best practices of asset-based lending and changes the way lenders do business.

Easier Integration

Offering unrivalled flexibility, replacing archaic manual ABL process and static banking systems with a flexible no-code solution. Crowd Machine ABL can easily integrate into existing systems, and core banking systems.

Better Automation

From loan origination, data collections, complex calculations, field exams, daily monitoring and reporting, the manual paper trail has been replaced by cloud-based processes, algorithm calculations, workflows, and outcomes. Tasks that used to take weeks or months can now be done in minutes.

Customer Experience

Crowd Machine ABL uses role-based portals that facilitate constant communication between lenders, borrowers, and third parties. Customer are able to upload data, make draw down requests, receive approvals, and provide electronic signatures, all online.

Schedule a demo today!

The need to work remotely has caused a large number of issues for most Asset Based Lenders, and their customers. The majority of ABL Systems provide limited remote access and basic remote data storage and retrieval, affecting not only you, but your customer. Crowd Machine’s ABL Solution changes the way lenders do business by giving you and your customers remote real-time access, with increased accuracy, efficiency, transparency, and confidence.

- Tailored To Your Operational Needs

- Easy To Create & Customizable Reports

- Smart Notifications and Real Time Alerts

- More Accurate Data Analysis

- Dynamic Borrowing Base

- Intelligent Processing

- Industry Standard Compliance & Security

- Accessible From Anywhere

- Customer Focused Solutions